Document Digitization

Document Digitization

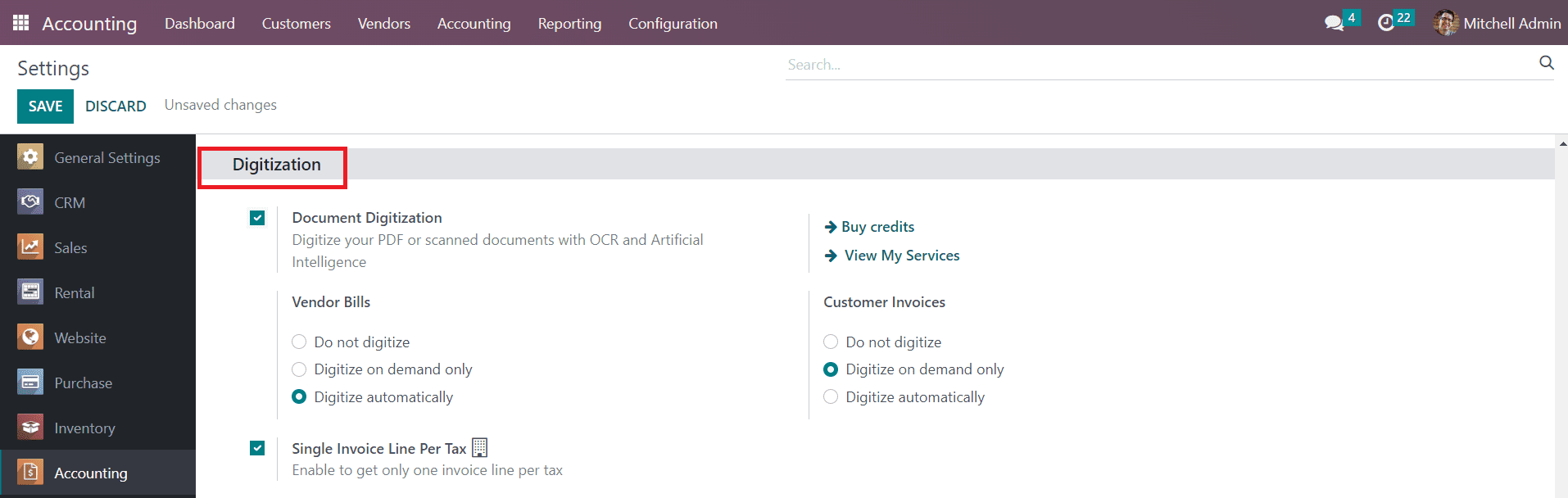

The Document Digitization feature in the Odoo Accounting module can be used to digitize your PDF or scanned documents with OCR and Artificial Intelligence. With this feature, you can manage your vendor bills and invoices easily on a daily basis. It allows you to gather all documents in the same place, and everything will be integrated into your database. With the OCR, all the documents will be automatically recognized and filled in your Odoo database. You can activate this feature from the Settings menu of the Accounting module.

After activating this feature, you can decide how to digitize the Vendor Bills and Customer Invoices. You can set the options as Do not Digitize, Digitize on Demand Only, or Digitize Automatically as per your requirements. This feature will be helpful to automatically encode your paper bills into vendor bills and customer invoices in your Accounting module. The Single Invoice Line per Tax can be activated to get only one invoice line per tax.

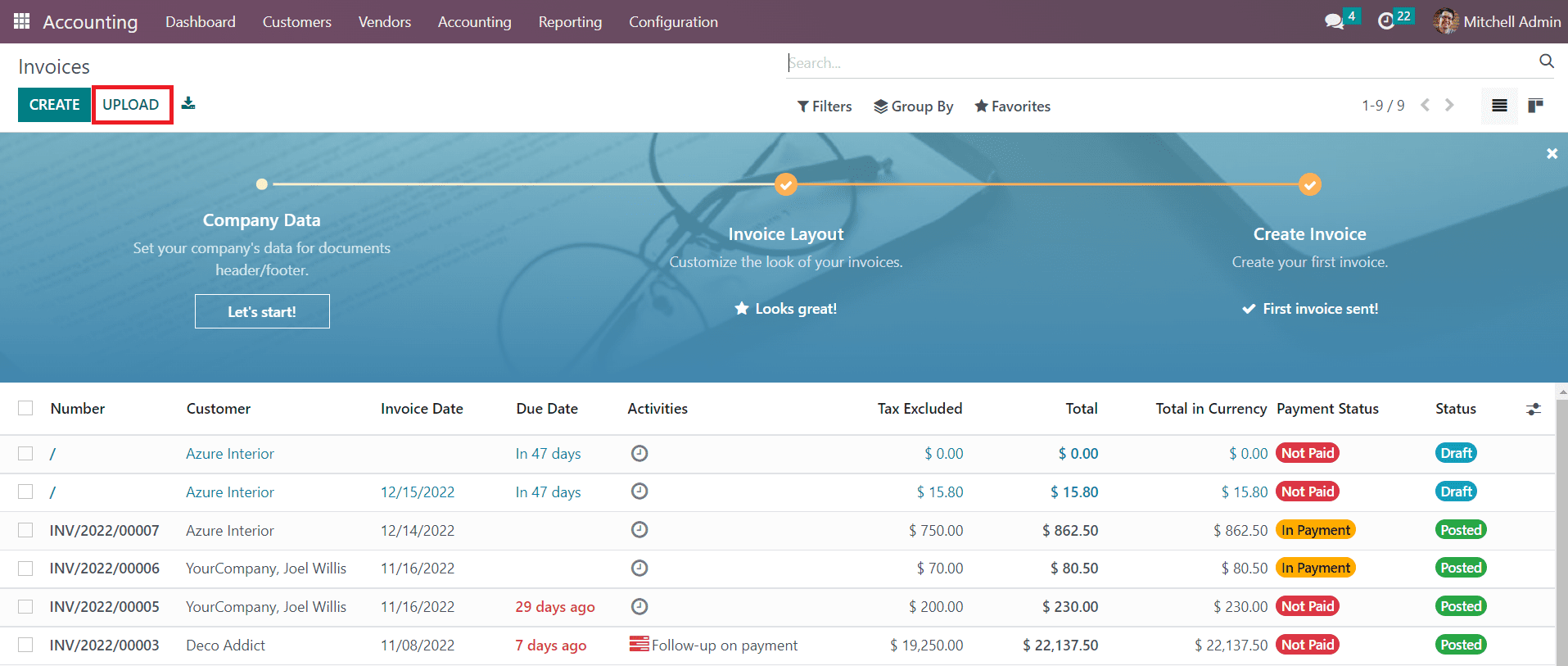

You can upload the bills and invoice manually or send scanned documents using an Email alias. You can use the Upload button available on the Customer Invoice and Vendor Bills platforms in the Odoo Accounting module to upload an invoice or bill to your system.

Here, we are going to upload a customer invoice using the Upload button available in the Invoices menu. Once you complete the process, the document will be processed automatically according to your settings and the details will be auto-populated in the fields of the invoice as shown below.

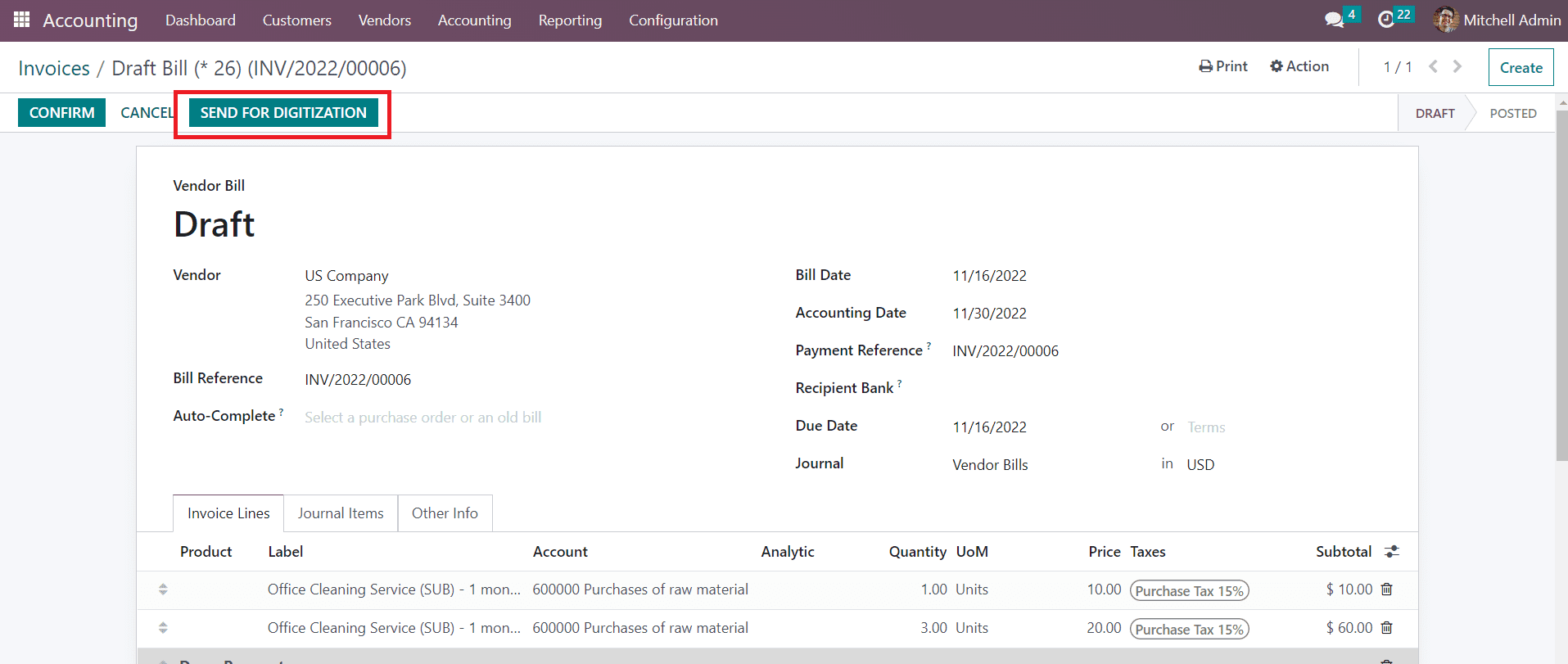

In order to do the process manually, you can click on the Send For Digitization button.

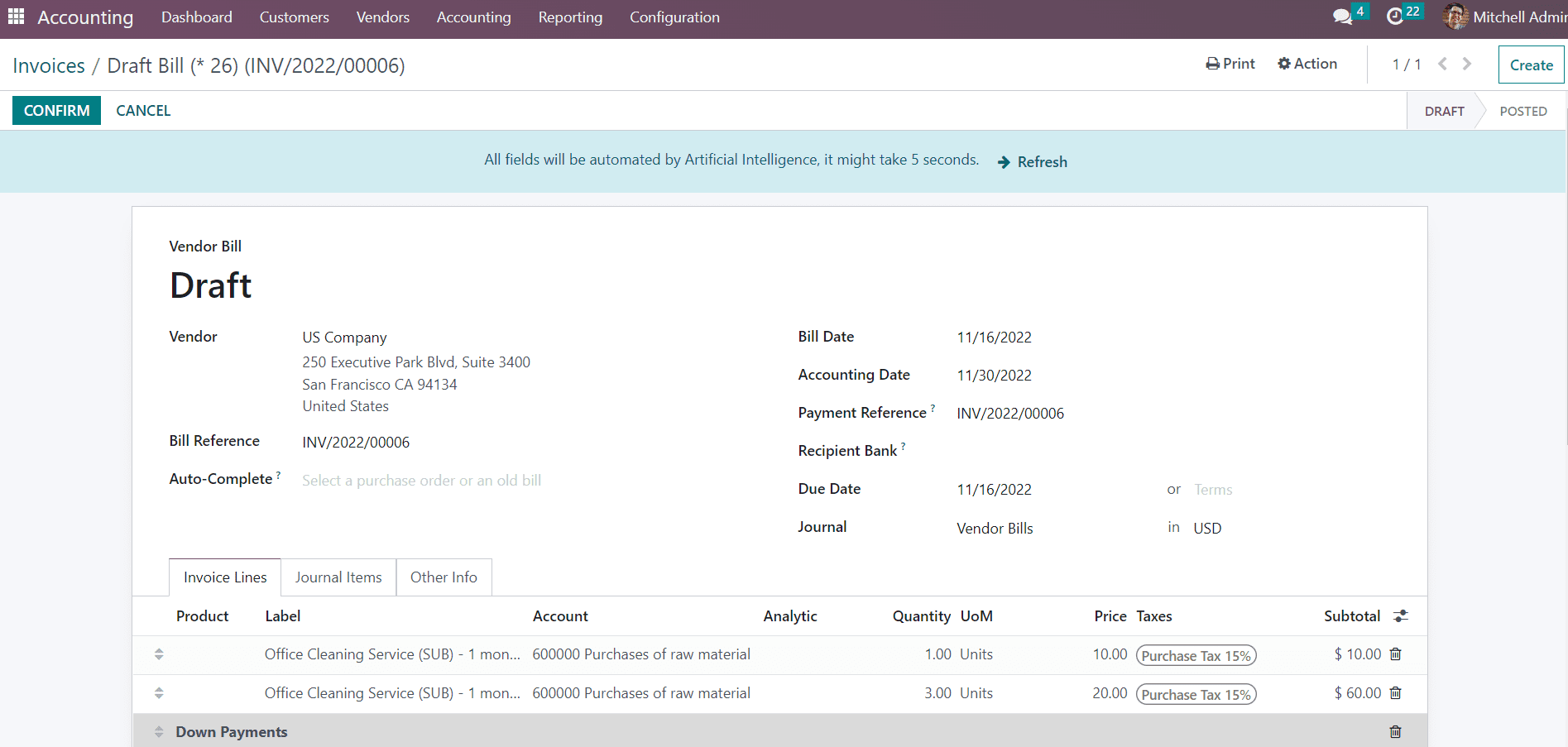

Once the details from the PDF or the scanned document are extracted to your system, you can check the data and make corrections if necessary. Remember that you need to buy credits in order to extract data from invoices.

Last updated