Cash Roundings

Cash Roundings

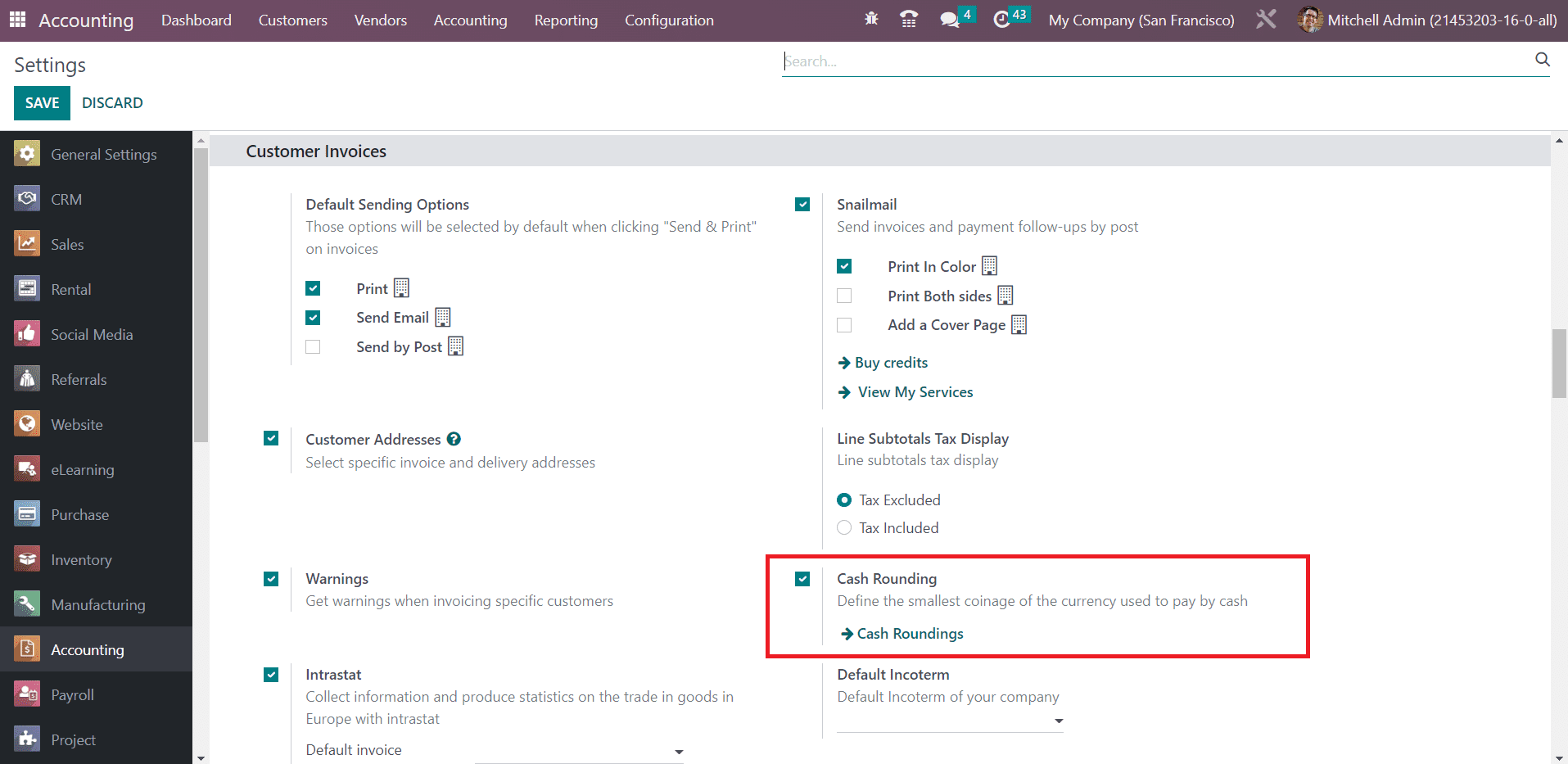

Cash rounding is used to define the smallest coinage of the currency used to pay by cash. You can use this feature in Odoo to round off the cost of a bill to the nearest available denomination of the currency. In order to get access to this feature, you need to activate the Cash Rounding option from the Customer Invoices tab as shown below. This option is available in the Settings menu of the Accounting module.

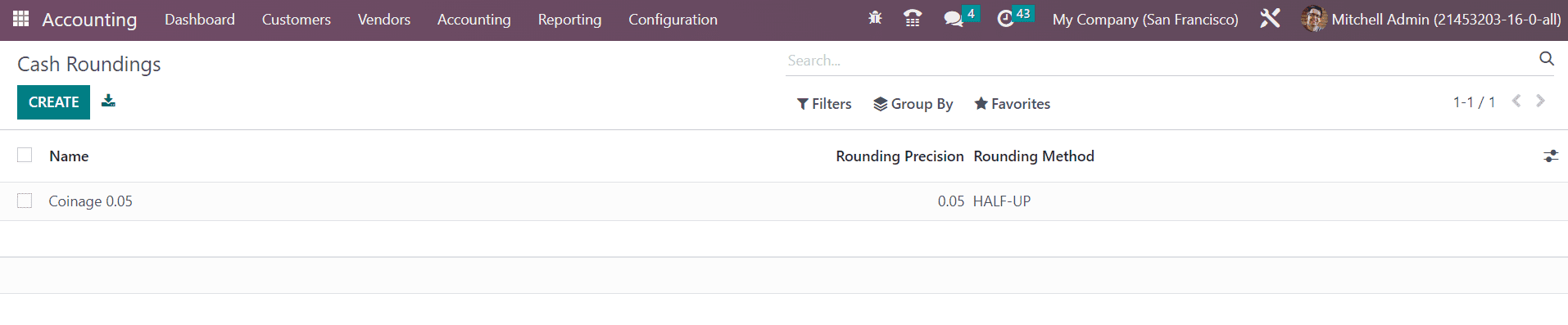

After activating this feature, you can go to the Configuration menu of the module and click on the Cash Roundings option.

The list view shows the details regarding the Name, Rounding Precision, and Rounding Method. In order to create a new cash rounding method, you can click on the Create button.

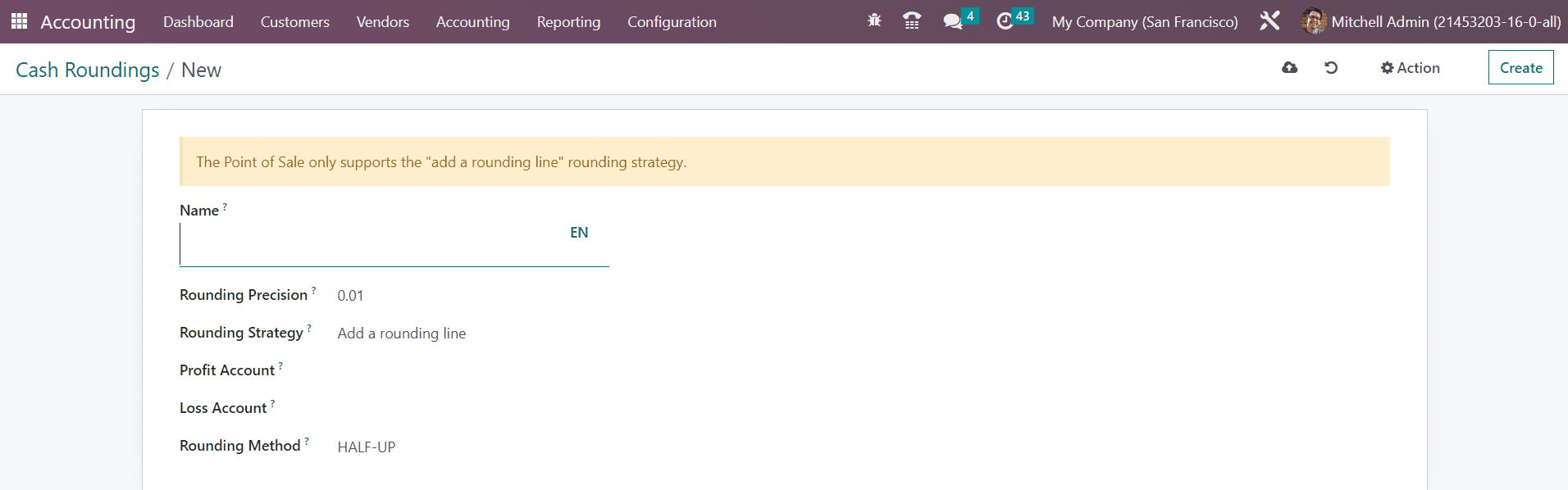

In the form view, mention the name of the new cash rounding method in the Name field. The non-zero value smallest coinage can be specified in the Rounding Precision field. Specify which way will be used to round the invoice amount to the rounding precision in the Rounding Strategy field. It can be either Add a rounding line or Modify tax amount. In the case of Add a rounding line, you are requested to mention the Profit and Loss Accounts in the corresponding fields. You will get three options to select as the Rounding Method. By choosing the Up method, the value will be rounded off towards the positive infinity according to the rounding precision. In the Down method, the value will be rounded off towards the negative infinity according to the rounding precision. The third option is the Half-Up method. You can use this method for fractional values. When the fractional part is greater than or equal to 0.5, the value will be rounded off towards the positive side and the value will be rounded off towards the negative side if the fractional part is less than 0.5.

Last updated