Disallowed Expenses

Disallowed Expenses

In accounting operations, the disallowed expenses are considered as the expenses that can not be deducted from the fiscal results but the user can perform deduction of such expenses from the bookkeeping results. Using the Disallowed Expenses Categories feature of the Odoo Accounting module, you can generate adequate financial reports in real-time. Go to the Configuration menu and click on the Disallowed Expenses Categories button.

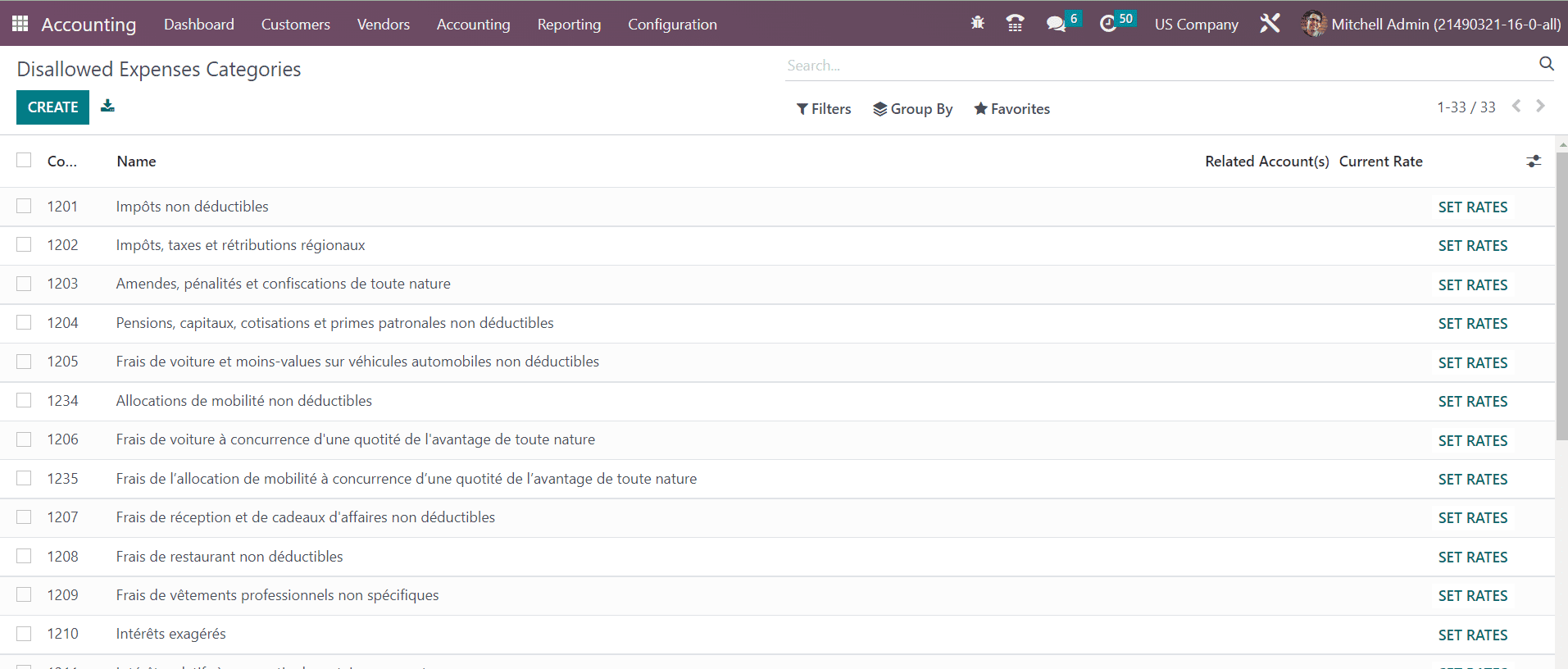

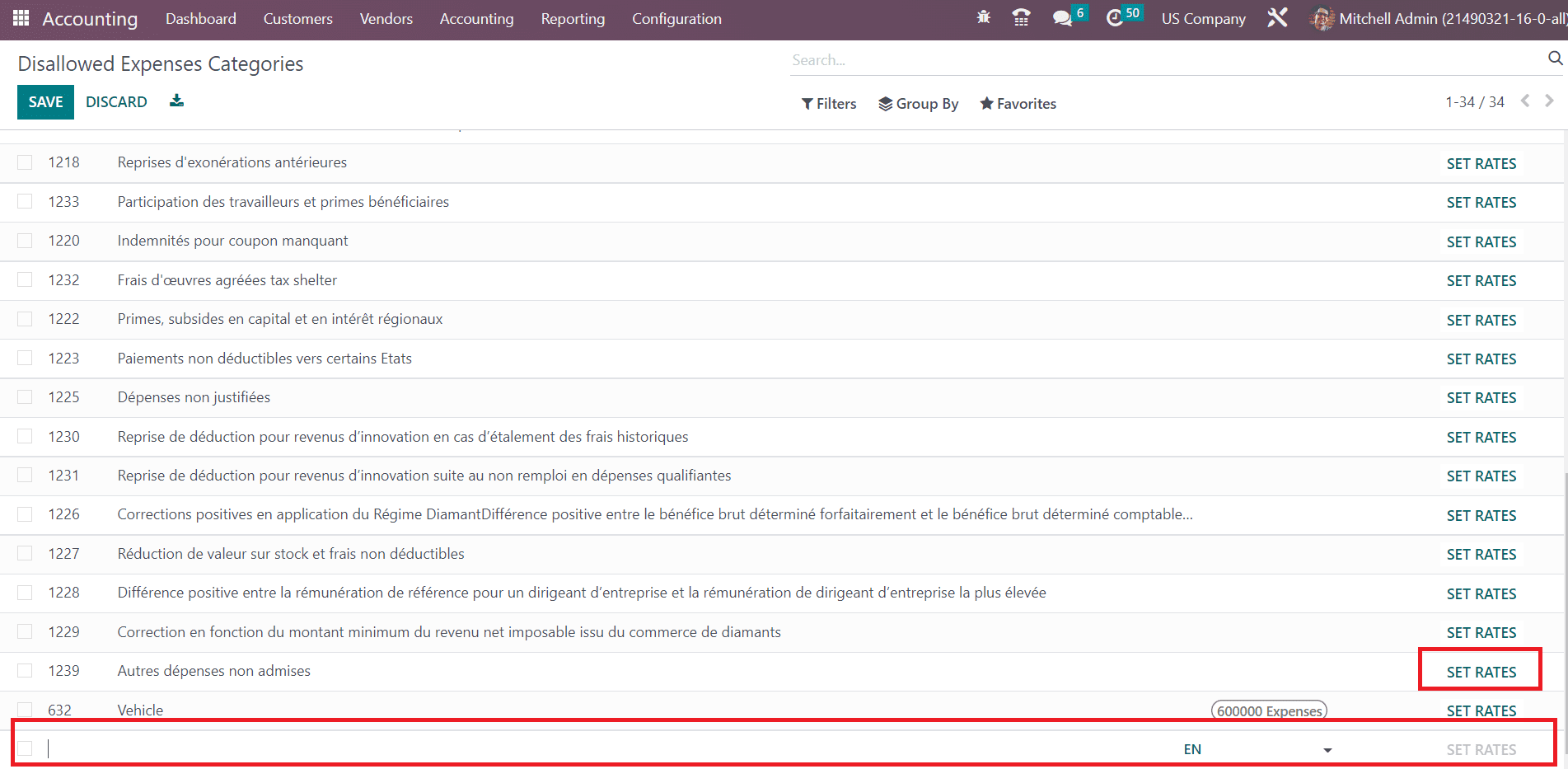

Pre-configured disallowed expense categories can be observed in this window. By clicking on the Create button, a new line will appear under the existing list to specify the Name, Related Account, and Current Rate.

You are allowed to click on the Set Rates button to set rates for the disallowed expenses categories. Clicking on any of the available categories will direct you to the form view of the respective category where you can edit the available data and set rates.

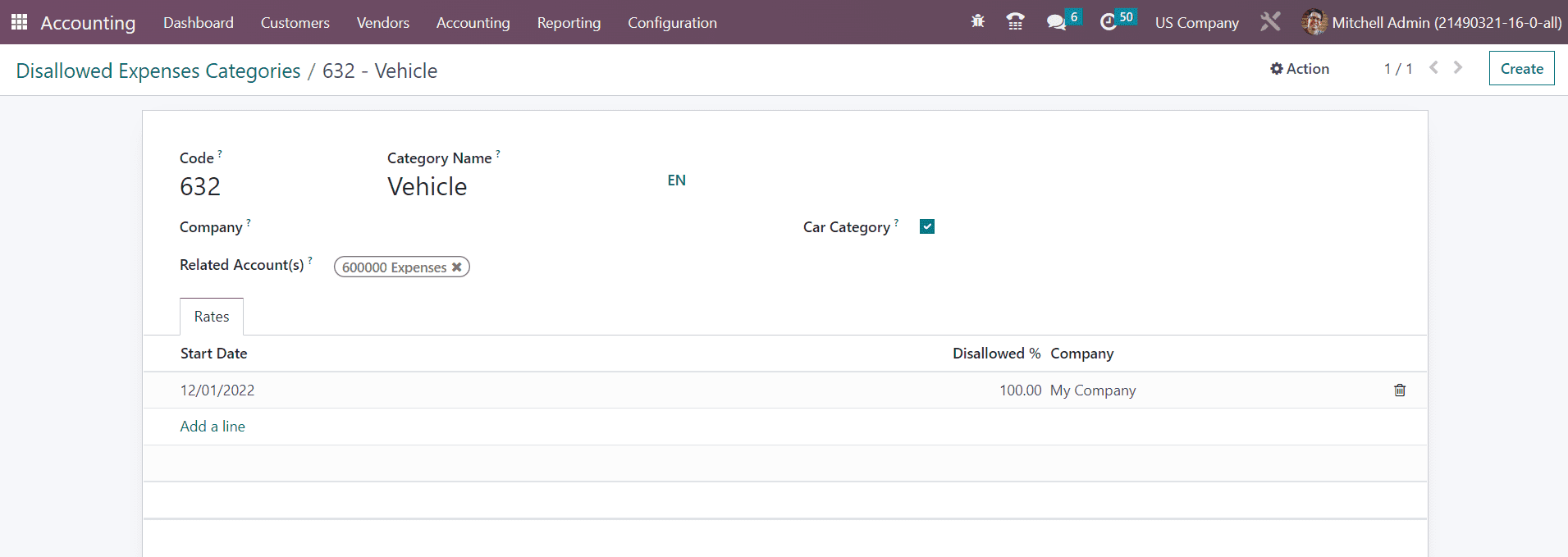

The screen shows the Code, Category Name, Company, and Related Account details of the expenses. The Car Category field makes the vehicle mandatory while booking a vendor bill. Under the Rates tab, the rates can be added one by one using the Add a Line button with the details of the Start Date, Disallowed %, and Company.

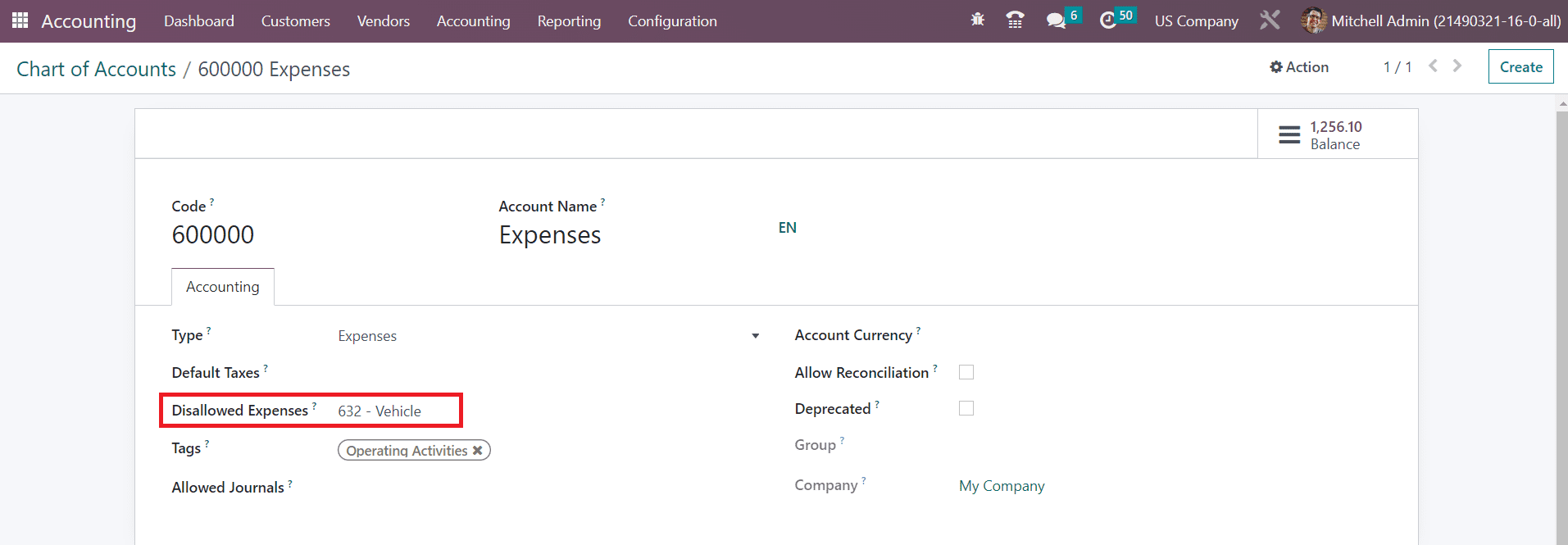

It is possible to link the disallowed expenses category with an expense account described in the Chart of Accounts platform.

By doing so, the disallowed expense will be calculated according to the disallowed expense category mentioned in the expense account when a new expense is created with this account. In order to generate Disallowed Expenses reports, you can go to the Reporting menu of the module.

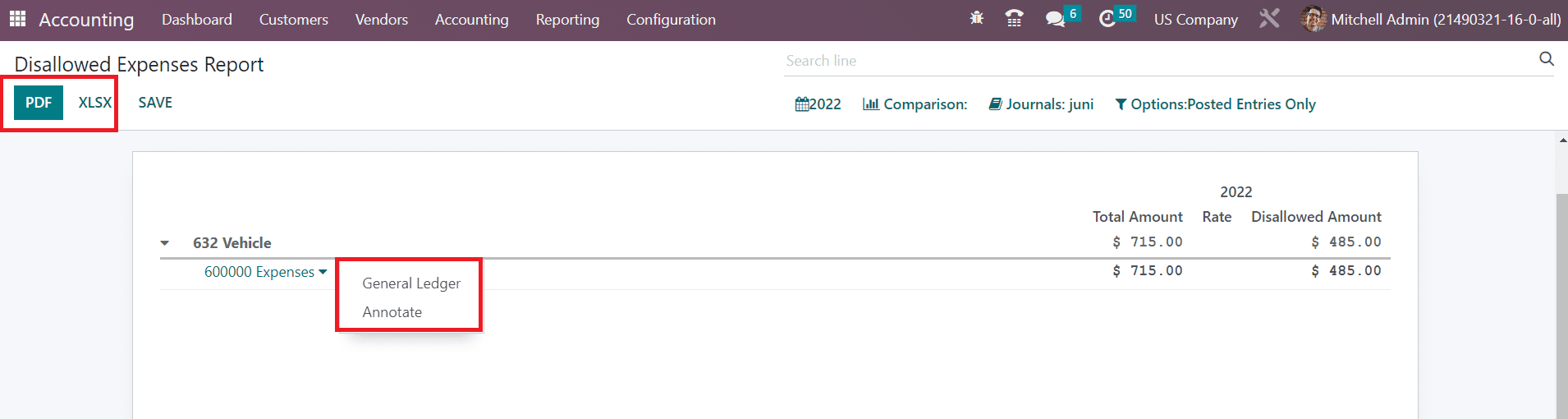

You can convert the report into PDF and XLSX formats using the respective buttons available on the screen. You can analyze the general ledgers related to the reported disallowed expenses by using the General Ledger button. The Annotate button can be used to add footnotes to the report.

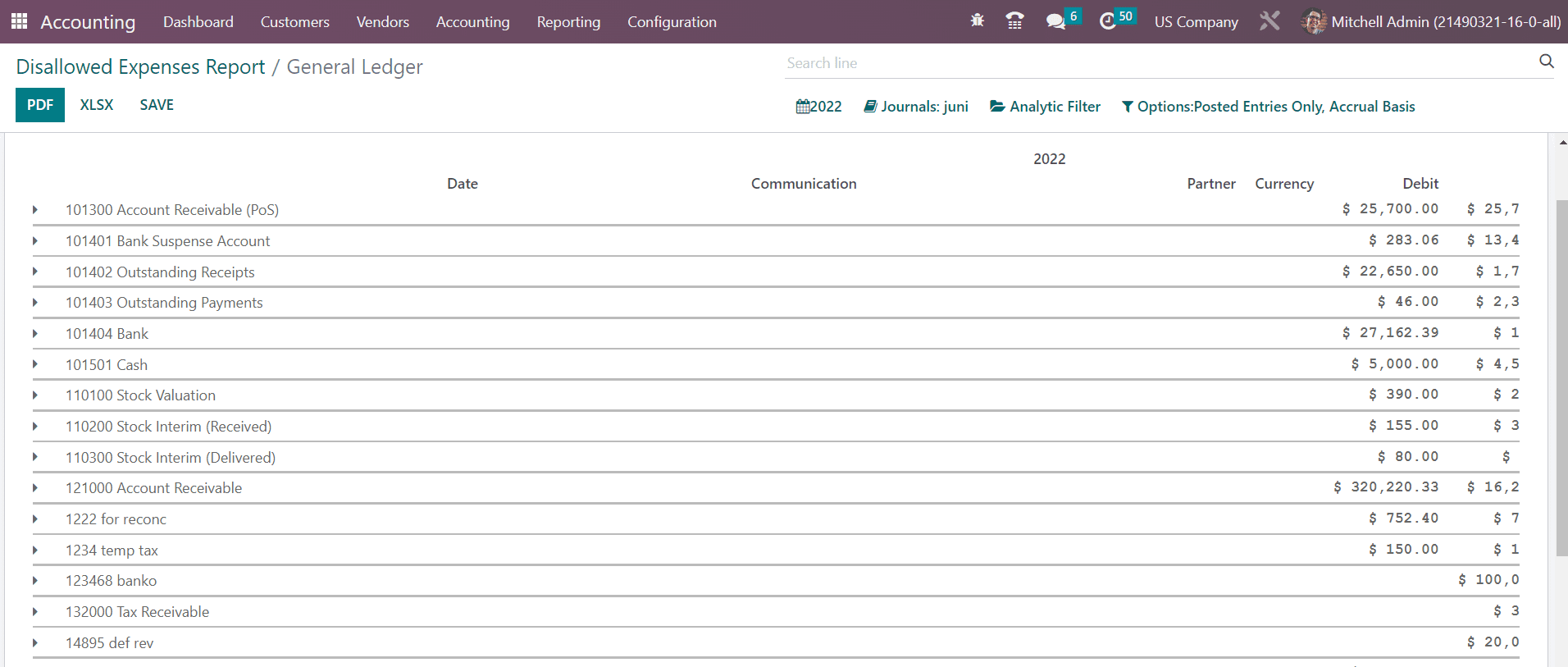

The report shows the journal items, Date, Communication, Partner, Currency, and Debit details of the general ledgers of the disallowed expenses of the selected time period.

Last updated