Chart of Accounts

Chart of Accounts

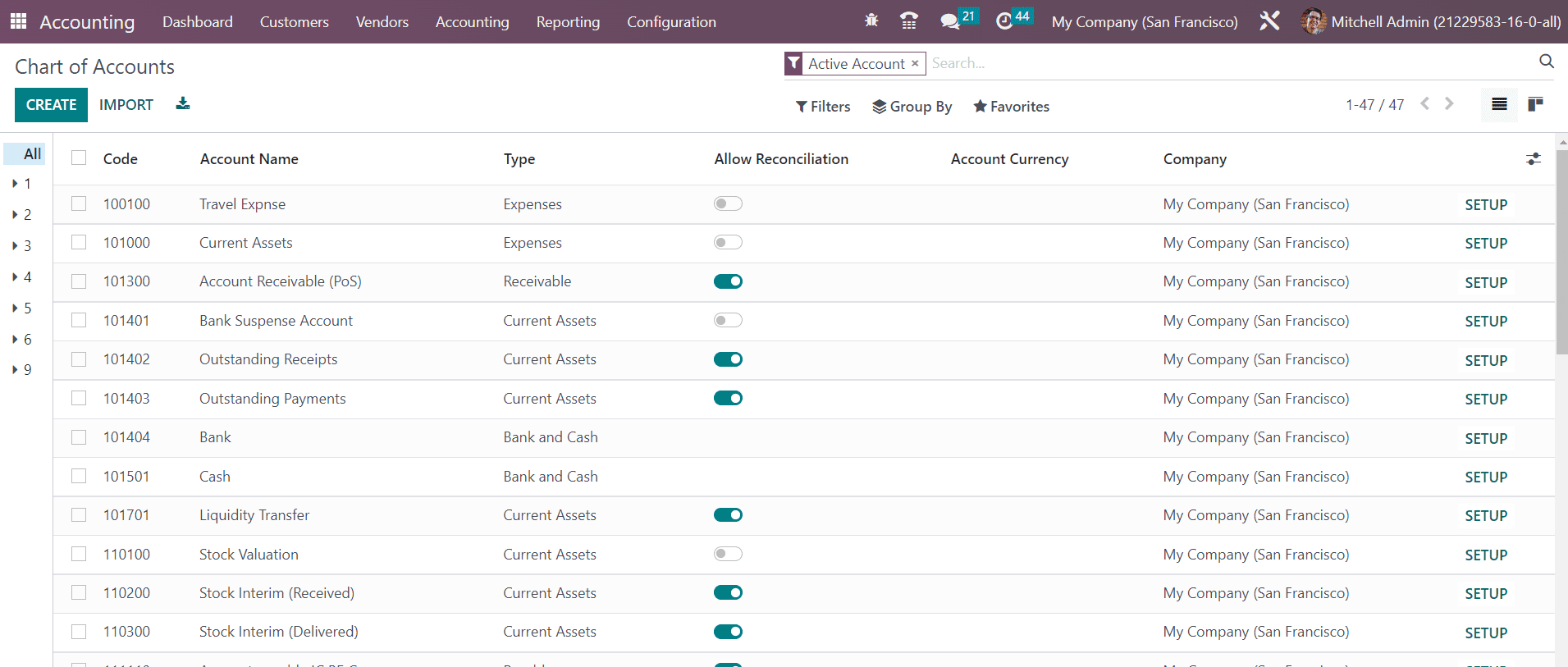

The list of all accounts used for recording the financial transactions in the general ledger of a business organization can be found in the Chart of Accounts. This list of accounts will keep a track of all financial dealings done in a company. From the Configuration menu of the Accounting module, you will get access to the Chart of Accounts platform. Based on your requirements, you can manage the existing accounts as well as create a new one without any difficulties.

The preview of the list view of the Chart of Accounts is shown above. It includes the Code, Account Name, Type, Allow Reconciliation, Account Currency, and Company details. The account type mentioned in the Type field is used for information purposes, to generate country-specific legal reports, and set the rules to close a fiscal year and generate opening entries. By activating the Allow Reconciliation field, the account allows invoices and payments matching of journal items.

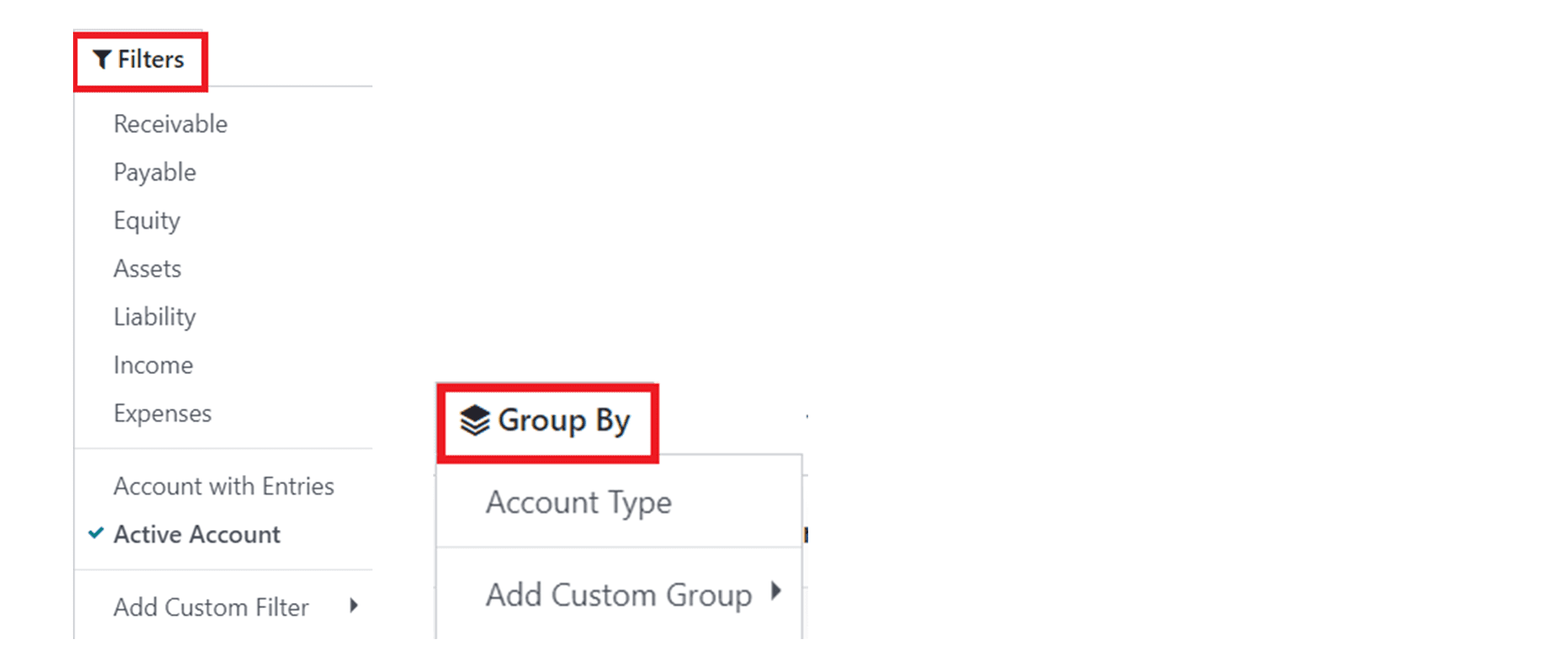

The available default filters are Receivable, Payable, Equity, Assets, Liability, Income, Expenses, Account with Entries, and Active Accounts. You can use them to filter the list of charts of accounts. Customized filters can be easily created using the Add Custom Filter option. Based on Account Type, you can group the accounts. For creating more customized grouping options, use the Add Custom Group option.

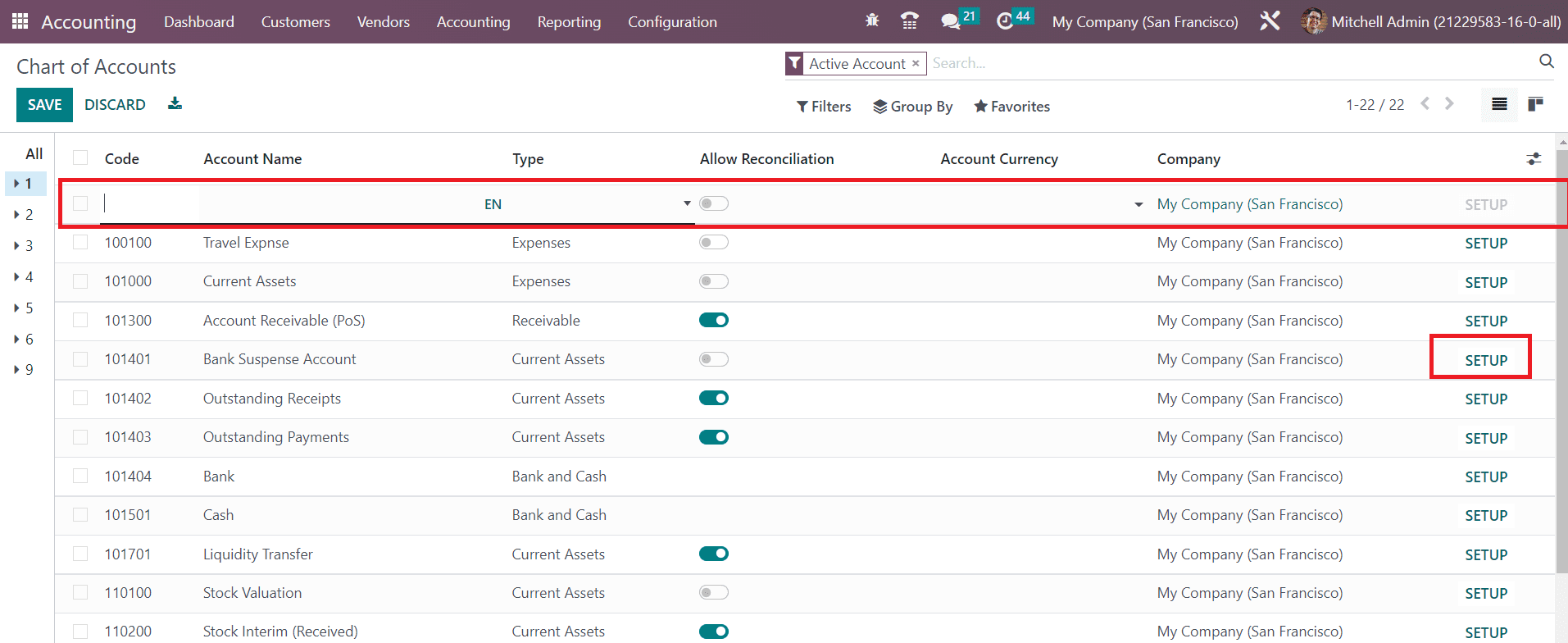

By clicking the Create button, it is possible to add a new account to this list. As shown in the image above, you will get a new line as soon as you click on the Create button to mention the details of the account. Additional changes and edits can be made on an account using the Setup button.

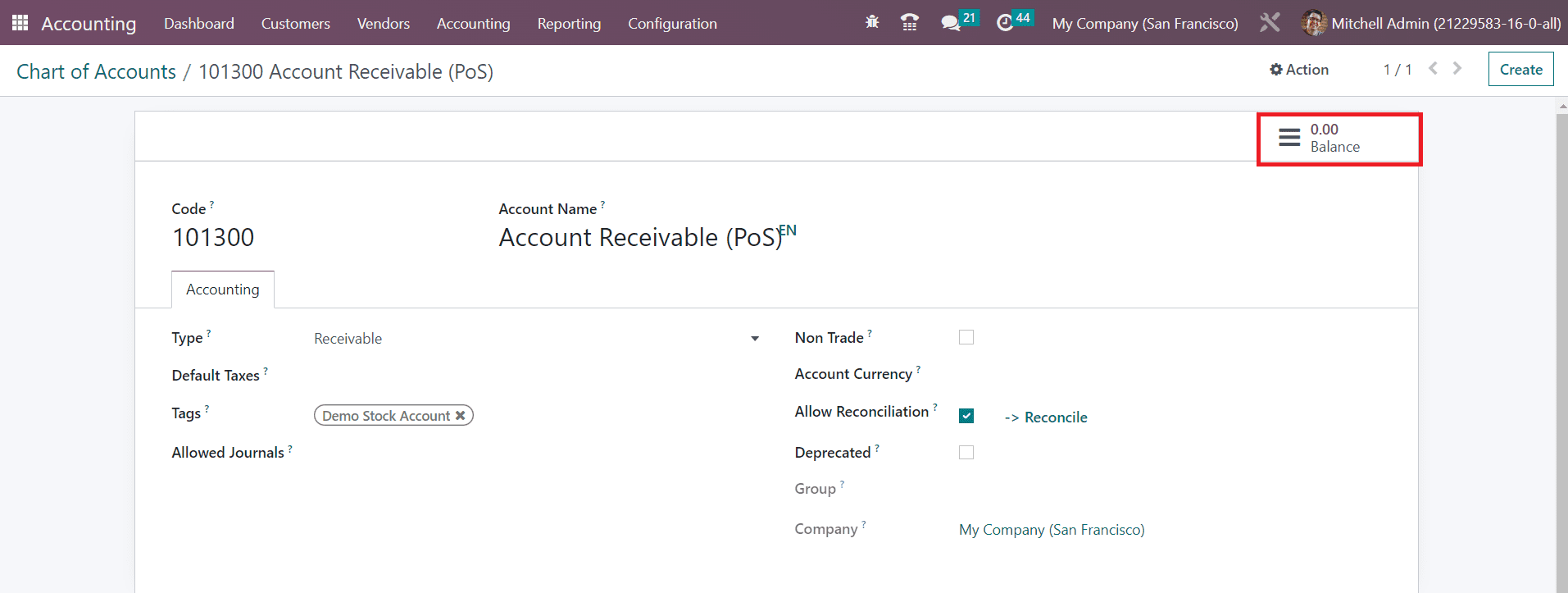

The Balance button will show the debit and credit balances of the account.

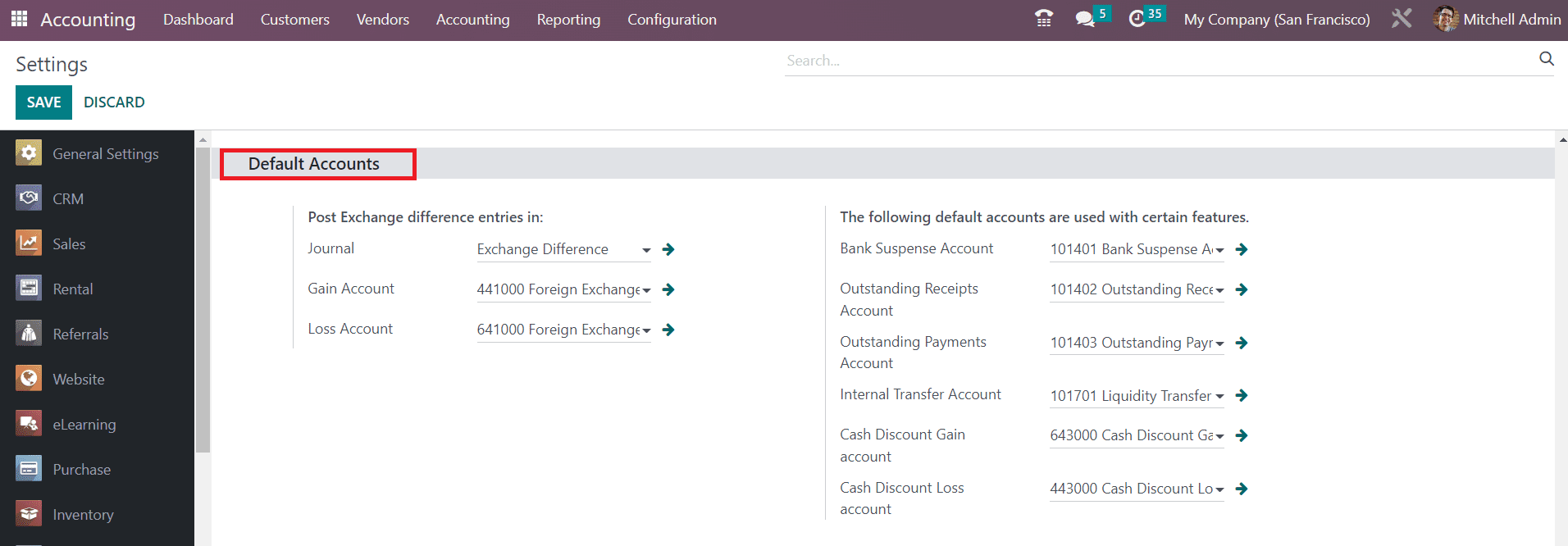

Default Accounts

In the Settings menu of the Accounting module, you will get a separate tab to define the default accounts used for various operations in your company.

Here, you can set default Journal, Gain Account, and Loss Account to post exchange difference entries in your accounting. Additionally, you can specify default accounts used for specified accounting operations. It includes Bank Suspense Account, Outstanding Receipts Account, Outstanding Payments Account, Internal Transfer Account, Cash Discount Gain Account, and Cash Discount Loss Account.

Last updated