Accounting Reports

Accounting Reports

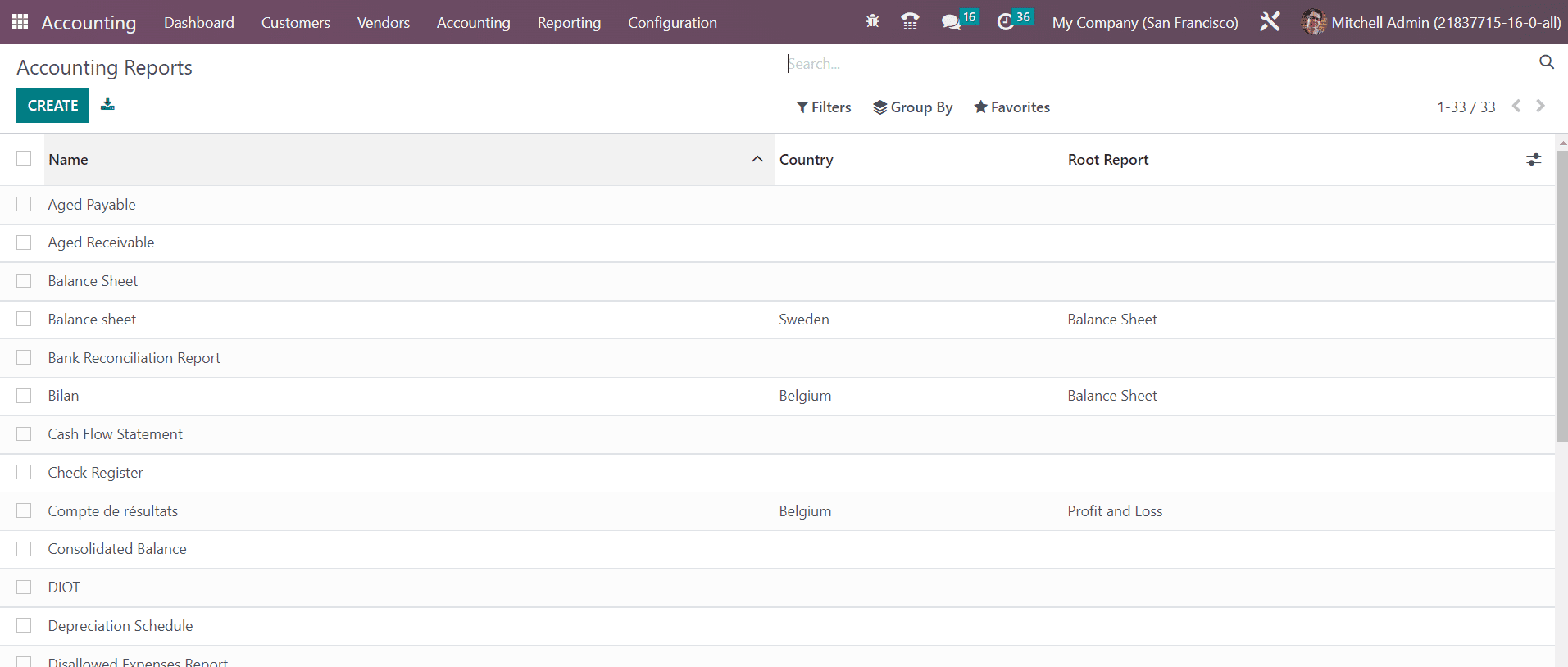

For making the reports more informative and understandable, Odoo offers a new feature for customizing your accounting reports. If you want to customize the accounting reports of your company according to your requirements, you can go to the Accounting Reports option given under the Configuration menu of the Accounting module. This platform will assist you in creating reports that suit your needs. You can change the configuration of the already existing reports also by selecting the corresponding one from the given list, as shown below.

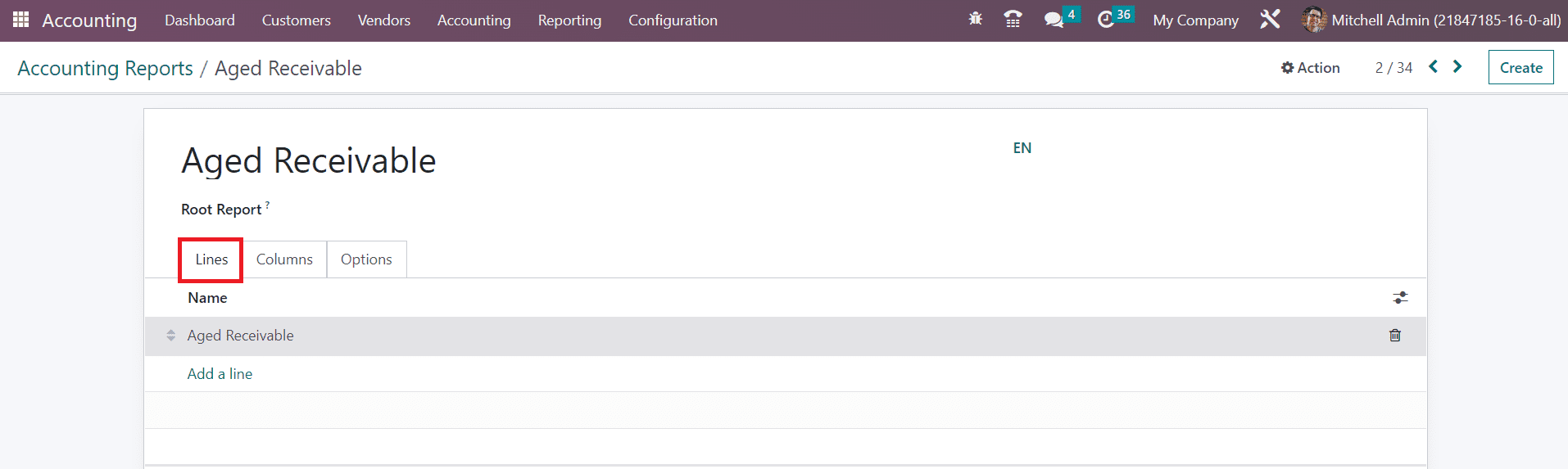

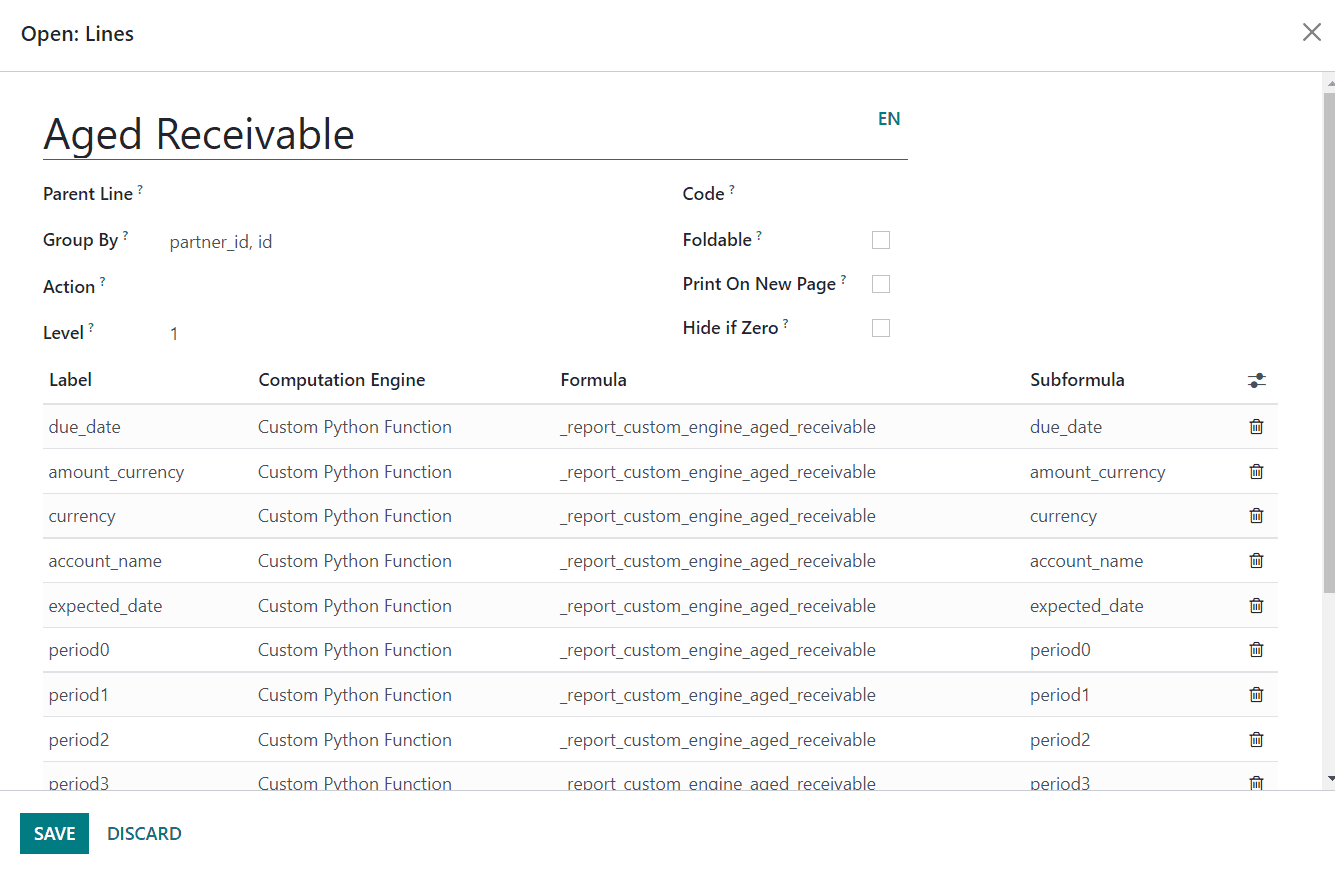

Let’s detail this feature through an example. Here, we are going to customize the report of Aged Receivable. For this, you can select the Aged Receivable from the list.

The name of the report will be available here. In the Root Report field, you can mention the root report, and the current report will be a variable of the mentioned root report. Under the Lines tab, you can specify new report lines using the Add a Line button. You will get a pop-up window to configure the details of the new report line.

Here, we are creating a new report line called Aged Receivable in our financial report. In the Partner Line, you can specify the partner id of this reporting line. A separate list of fields will appear in the report line by mentioning the keys in the Group By field. If you want to turn the report line into a link, you can use the Action field. The Level field will show the hierarchical level of this report line. You can specify a unique identifier for this line in the Code field. By activating the Foldable field, a folding button will be displayed on the report to fold this line. When the Print on New Page button is activated, everything after it will be printed on a new page. By enabling the Hide if Zero feature, Odoo will automatically hide the line when all of its columns are 0. Using the Add a Line button, you can specify the Label, Computation Engine, Formula, and Subformula.

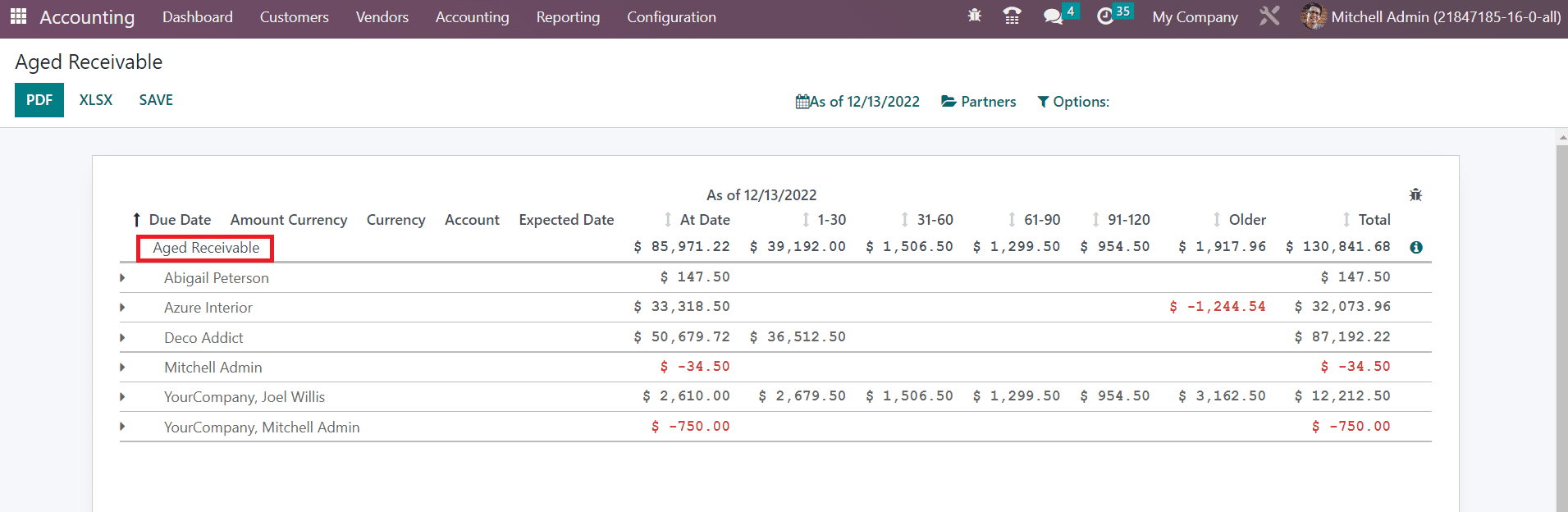

After creating a new line, you can observe the new reporting line in the Aged Receivable report as shown below.

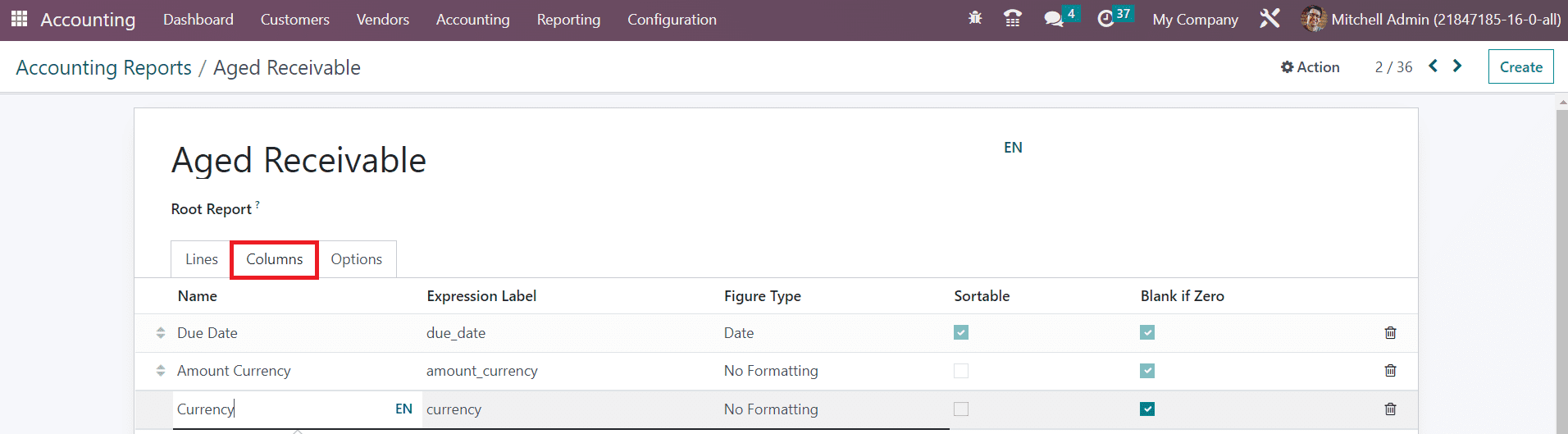

Now, let’s create a new column for the report. Under the Column tab, you can create new columns for the Aged Receivable report by clicking on the Add a Line button.

Here, we are adding the column Currency to our report. You can mention the Name, Express Label, and Figure Type in the respective fields. The Sortable and Blank if Zero fields can be activated as per your demand.

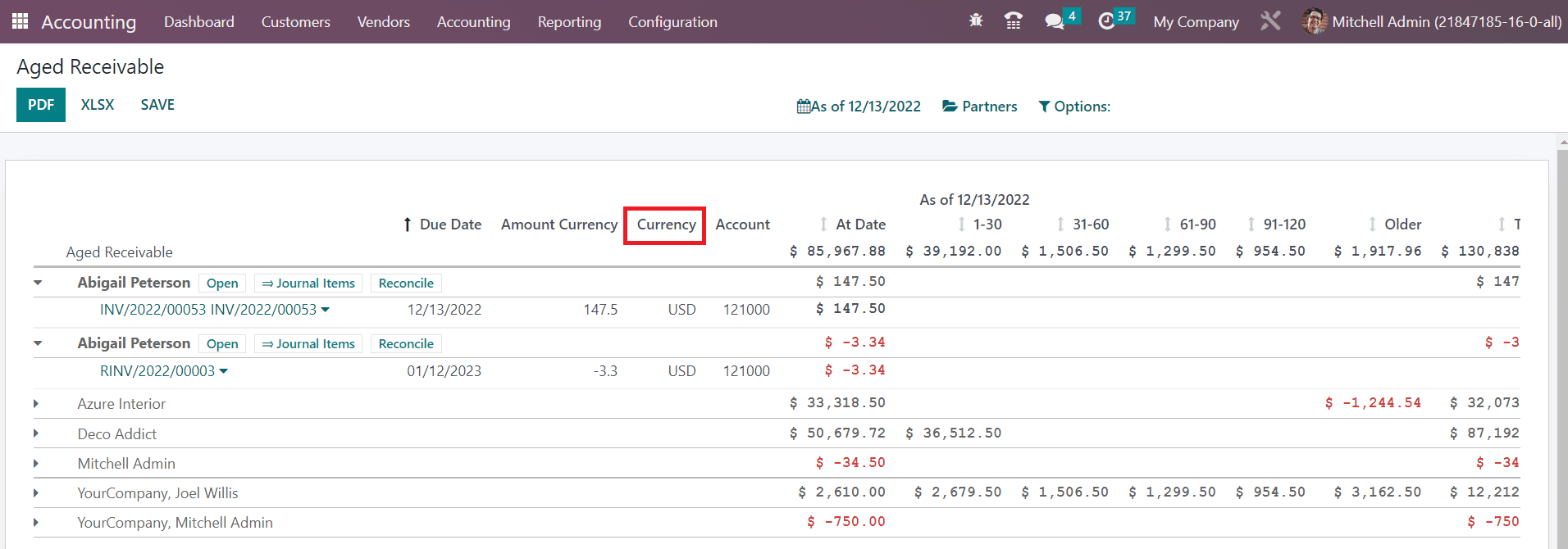

As shown in the image above, the new column Currency will be available in the Aged Receivable report.

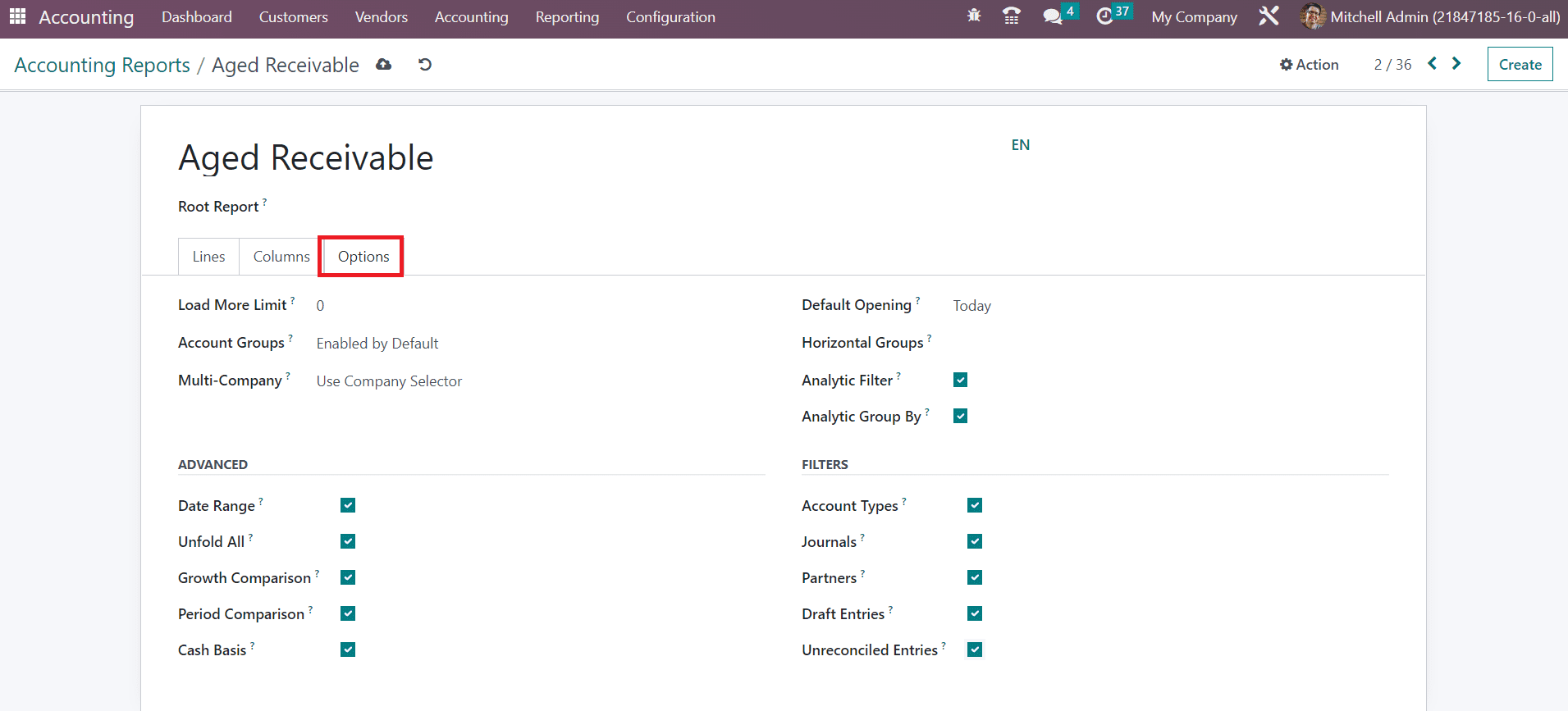

Under the Options tab, you will get advanced customization options to create the report at your convenience.

The limit value can be set in the Load More Limit field. You can set the Account Groups feature as Enabled by Default, Never, or Optional. The filter Multi Company can be adjusted based on the Use Company Selector or Use Tax Unit. Set the field as Disabled if you want to disable the Multi-Company filter option. The Default Opening field can be used to set a time period and to show the report of the selected time period as default while opening the Aged Receivable report in Odoo. The required Horizontal Groups can be added in the given space. You can activate the Analytic Filter and Analytic Group By options if you want to provide more sorting options in your reports.

If you want to show the Date Range, Unfold All, Growth Comparison, and Period Comparison features on the Aged Receivable report, you can activate the corresponding fields from the Advanced session. Activating the Cash Basis field will display the option to switch to cash basis mode. In order to add additional filters to the report, you can enable the Account Types, Journals, Partners, Draft Entries, and Unreconciled Entries from the Filters session.

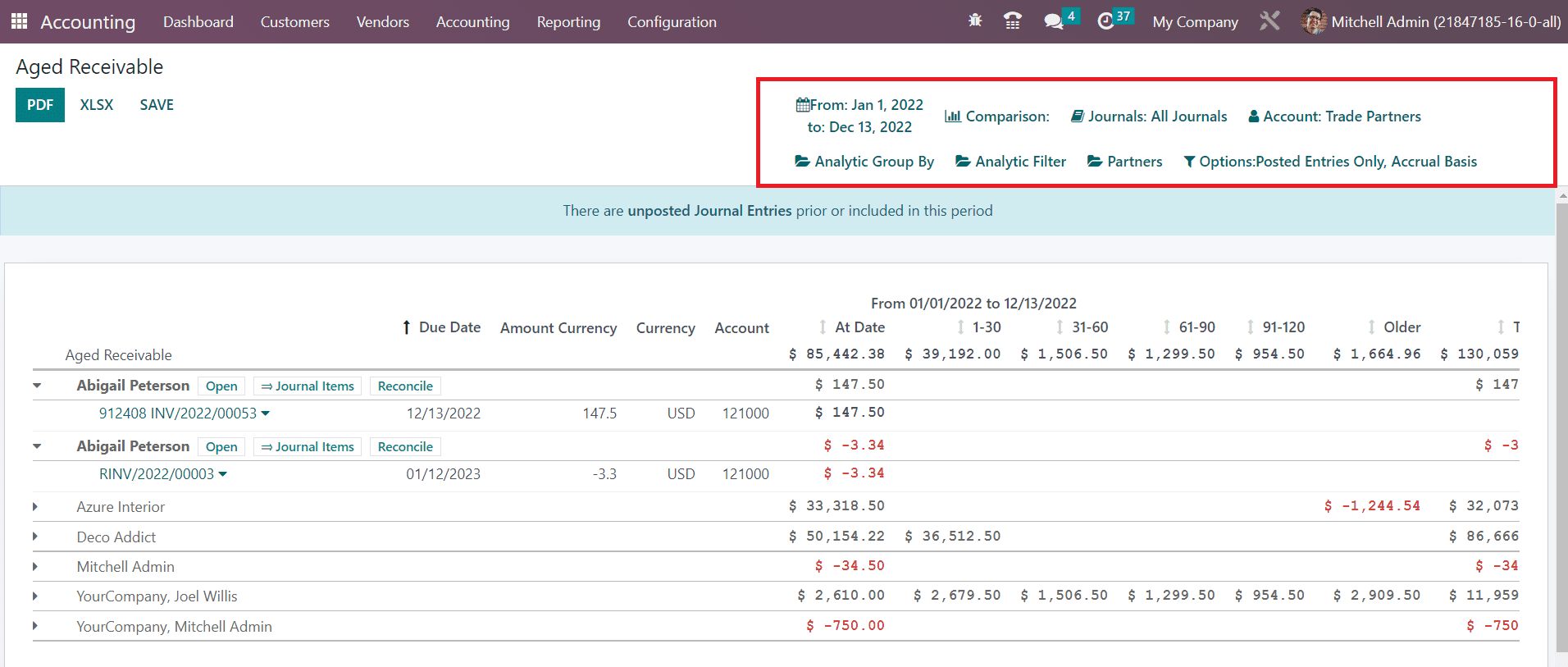

After making the necessary changes in the settings of the Aged Receivable report, you can observe corresponding changes in the reporting platform as shown in the image below.

Using the dedicated Accounting Reports feature, you can customize your financial reports to make them more advantageous enough to perform an excellent analysis of the financial operations done in your organization.

Last updated