Lock Dates

Lock Dates

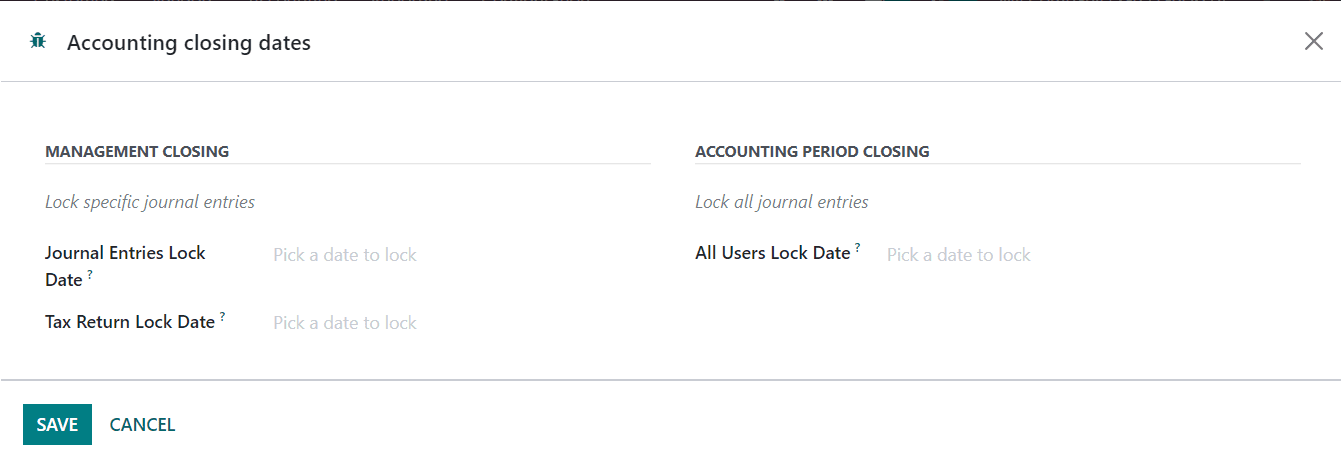

Locking the accounting period is necessary to avoid the chances of posting accounting entries into the previous period. In the Odoo Accounting module, you can easily set accounting closing dates from the Accounting menu. In this menu, you will get the Lock Dates option which directs you to a pop-up window as shown below.

Under the Management Closing tab, you can lock specific journal entries by mentioning the Journal Entries Lock Date in the respective field. By doing so, Odoo will prevent journal entries creation prior to the defined date except for account users. You can pick a date to lock in the Tax Return Lock Date to prevent Tax Returns modifications prior to the defined date (journal entries involving taxes). The Tax Return Lock Date is automatically set when the corresponding journal entry is posted. It is possible to lock all journal entries from the Accounting Period Closing tab. Pick a date in the All Users Lock Date field that will prevent journal entry creation or modification prior to the defined date for all users. As a closed period, all accounting operations are prohibited once you set a lock date.

Last updated